Editorial Introduction

Over the course of his life, Luciano Ferrari Bravo (1940–2000) managed to train several generations of militants – a true cattivo maestro in the classrooms, factories, and streets of Italy’s northeast. 1 From the early 1960s on, he spent long days outside the petrochemical plants of Porto Marghera in his native Veneto, an industrial complex well-known for the many battles waged there by autonomous councils and assemblies of workers. In 1963 he and his lifelong comrade Antonio Negri helped to found the local organization Potere Operaio veneto-emiliano, and around this time Ferrari Bravo began publishing analyses in the group’s own paper as well as contributing dispatches to the Cronache Operaie, a national roundup of working-class self-activity published by Quaderni Rossi. His subsequent interventions in political strategy and Marxist theory appeared in national movement publications such as Classe Operaia, Contropiano, Potere Operaio, and Autonomia, on whose editorial board he also served.

For his entire adult life, excepting the five years he spent in jail awaiting trial on charges of insurrection against the state, Ferrari Bravo also worked in the University of Padova’s political science program, where he participated in an extraordinary collective of radical researchers including Sergio Bologna, Mariarosa Dalla Costa, Alisa Del Re, Ferruccio Gambino, and Negri. Along with others in this milieu, he was an operaista but no unthinking factoryist; in the mid-1970s Ferrari Bravo also helped to found Radio Sherwood, which played a vital role in maintaining the ecosystem of the extra-parliamentary left around Padova. During this time he authored several meticulously documented contributions to collections in Feltrinelli’s “Materiali Marxisti” series, edited first by Bologna and Negri, and later by the collective as a whole. 2 “Old and New Questions in the Theory of Imperialism,” the essay which we have translated below, originally served as an introduction to one of those volumes, Imperialismo e classe operaia multinazionale (“Imperialism and the Multinational Working Class”). 3 That collection, edited by Ferrari Bravo, brought together writings from Marxian and non-Marxian authors seeking to grapple with developments in the global structure of capital and international working-class struggle in the mid-1970s.

On the subject of imperialism, Ferrari Bravo was determined to register not only the overt violence of colonization and imperial expansion but also the international mobility of capital and of labor-power, giving special attention to historical developments – firstly, to the possible constitution of a unified global capitalist cycle after the second world war, and, secondly, to U.S. President Richard Nixon’s announcement of the end of the gold-dollar standard underpinning international exchanges in 1971. Before this essay, Ferrari Bravo had distinguished himself within operaismo by bringing his political perspective to bear on the margins – not only to the peripheral neighborhoods of Italy’s northern industrial triangle where southern Italian migrants lived, but to changing dynamics within the South itself. In “Forma dello stato e sottosviluppo” (“Form of the State and Underdevelopment”), Ferrari Bravo analyzed the partial industrialization of the South through the state’s Cassa per il Mezzogiorno (“Fund for the South”) as a political response to the increasing mobility of labor-power. This “plan” of reforms was designed to integrate cycles of workers’ struggles into the productive cycle of capital. 4 In “Old and New Questions in the Theory of Imperialism,” Ferrari Bravo elaborates this research within the expanded frame of the world market, harvesting what he deems useful from Marx, Lenin, and subsequent theorists to develop a rigorous analysis of his current conjuncture.

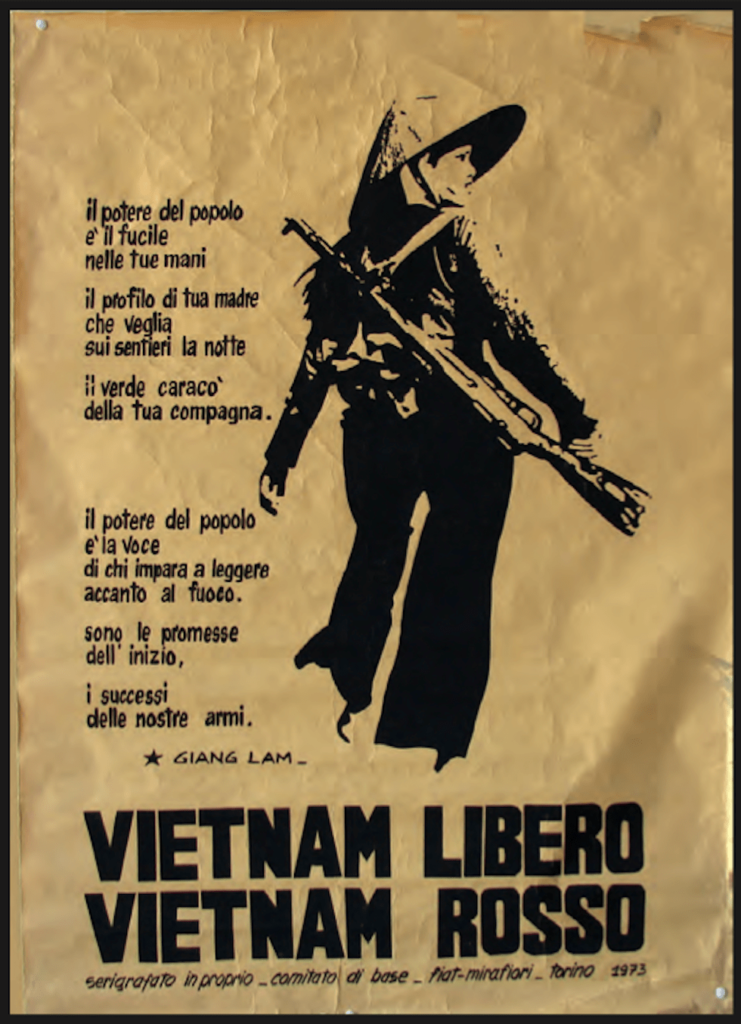

Although this essay focuses on the capitalist counterrevolution of the 1970s, it is important to emphasize that Ferrari Bravo understood that process as the counterfoil to the primacy of working-class antagonism. He interprets the abandonment of the convertibility of dollars into gold as a response by the U.S. capitalist state to the tenacity of Vietnamese resistance as well as to the global wave of student and worker struggles that shook the states and capitalist cycles of countries in which U.S. multinationals were heavily invested. 5 But the end of the gold-dollar standard had yielded contradictory developments – floating exchange rates, competition between currencies, and new relationships between individual nation states and national and international cycles of capital – which recomposed classes and restructured the terrain upon which both proletarians in the metropoles and anti-imperialist revolutionaries in the colonies would continue to move.

The question for Ferrari Bravo becomes, then, how to operate politically on this global level. 6 Certainly if the United States had proven itself “capable of transforming itself gradually, without losing solidity but rather by increasing the intensity of its total rule,” and if the apparatuses of the state had become agents of an “international cycle of capital hinged on the multinationals,” 7 this would necessitate important amendments to the theory of imperialism advanced by Lenin in his famous pamphlet, which emphasized competition between different national capitals. In order to develop a new theory, Ferrari Bravo suggests “returning to Lenin by way of Marx.” 8 Rather than mine the written records of Lenin’s 1917 intervention for scientific concepts – Ferrari Bravo suggests abandoning the categories “labor aristocracy” and “parasitism” to the gnawing criticism of the mice – instead he looks to Marx for a methodology and framework within which to pose this political question anew. If Lenin’s great contribution was to recognize that “imperialism is a global figure of the political command of capital over labor-power,” 9 then the return to “Lenin,” here, does not mean restoring fidelity to an old explanatory schema, but rather taking up again the project to read new international developments in capitalist processes of accumulation from the viewpoint of the proletariat in its global struggle for communism.

Such a recognition of the need to take distance from certain formulations in Lenin’s work while embracing the spirit of his discourse could only have been sharpened by the unique political context in which Ferrari Bravo made his own intervention. Not only had the international situation changed, but on the radical left in Italy, clandestine and armed tendencies were beginning to emerge, many of which sought to import guerrilla warfare tactics from national liberation struggles into their own practices. 10 Without dissecting those movements in depth, Ferrari Bravo identifies a common problematic between those espousing “guerrilla warfare on asphalt” and “third-worldist” theorists of imperialism, the most emblematic being Arghiri Emmanuel. 11 Trapped within an orthodox reading of Marx as a theorist of political economy, Emmanuel understood imperialism as a static wage imbalance between core and periphery, a viewpoint which left him unable to grasp the most important factor of the wage: its expression of the “irreducible political subjectivity” of the proletariat. 12 Although Ferrari Bravo does not discount the revolutionary character of anti-colonial struggles, 13 he dissects the object of knowledge constructed by Emmanuel and attempts to produce a new thought-object suitable for “a two-pronged movement which unites [accomuna] the metropolitan worker and the proletariat of the Third World in an analogous violent demand for income and power.” 14 That this project remains unfinished today diminishes neither the trenchancy of his criticisms nor the perspicacity of his analysis.

Ferrari Bravo would be arrested on April 7, 1979, along with Negri, Paolo Virno, and more than 20 other militants. All were charged with fomenting armed insurrection and falsely accused of leading the Brigate Rosse (“Red Brigades”), the terroristic cell that had gained notoriety for committing high-profile assassinations. 15 He would be released and cleared of all charges only in 1984, thence returning to teach at Padova, and continuing to write alongside comrades old and new in the pages of Derive Approdi and Luogo Comune. Whether addressing the changing composition of the European working class in the ‘80s and ‘90s, measuring new strategies of incorporation developed by the Italian state, or analyzing the supposed novelty of “globalization” in relation to the history of the international mobility of labor-power, many of these later studies were built upon the foundations laid down in the present essay. Indeed, despite its “humble appearance as a review of studies,” 16 what follows constitutes a formidable development in Marxian theory on imperialism. Unencumbered by the dead weight of past traditions, it is guided by the militant impulse to investigate the changing composition of the international working class and the terrain on which it finds itself in order to plot the possible coordinates for a new cycle of struggles. This task must also be ours today.

– Andrew Anastasi

1.

“Interlocking versus socialization”: under this heading, in the “Preparatory Notebooks” to the writing of Imperialism: The Highest Stage of Capitalism, Lenin collects a series of readings and reflections on the latest phase of capitalist development. 17 “Interlocking” among banks, firms and public administrations, or real and proper “socialization” of production? The topic reappears, explicitly, in the final pages of the “popular outline,” and there it seems the comparison is posed in order to be refused. 18 It is not a matter of setting up an opposition between, on the one hand, “real socialism” – a hypothetical, absurd, general socialization arising through parthenogenesis from within development – and on the other, the apparently anarchic chaos of the myriad relations that are woven together precisely by capitalist restructuring. Instead, it is a matter of verifying that what unfolds before the eyes is an actual process of socialization of production, which is nevertheless being developed within a shell of “private economic relations and private property relations” that determine it from all sides and tend to cause its “decay.” It is, in a certain sense, the absolutely traditional thesis of the diachronic and conflictual relation between the productive forces and the relations of production. But, here, it avoids the abstract rigidification of (Second and Third Internationalist) ideology, and not only by virtue of the fact that it is renewed by a precise and, at times, meticulous analysis of “new developments.” Above all, by privileging the model of “actual socialization,” if only from the analytical side, Imperialism provides a perspective – a viewpoint – which is thoroughly working-class. No purely moral rejection, no search for contradictions or completely “external” alternatives, but, rather, the determination, from within development, of the general conditions, of the necessary terrain of the political-military clash between the classes.

Having said this, it should be immediately added that, if the Lenin of Imperialism reflects a historically determined level of the composition of capital on a world scale, if he interprets its dynamic tendencies according to a methodology that seeks to understand development starting from the highest point of political tension determined by it (a “workers’” methodology), if, finally, he intervenes in the process with all the subjective strength of which “Leninism” was the maximum political expression in that period – all this still does not “guarantee” us anything of the “validity” – for that time – of the specific interpretation of the phenomenon offered by the “popular outline,” and even less of its immediate usefulness today. On the contrary, all this serves only to stabilize a preliminary and, in a certain sense, negative point: that any discourse on Imperialism is, even today, a discourse on Lenin, but it must be so only in the sense of critique. It is certainly not a discourse on Lenin for the “philological” reason that Lenin is the “author” of the theory in question. From the viewpoint of its economic analysis, this bears so little truth that from the beginning Lenin himself recognizes his debt – and it is a substantial debt, as we shall see – to Hobson and Hilferding in this regard. 19 It is, instead, a discourse on Lenin because only in Lenin do we find no mere objectivism of economic analysis, but the grand tactics of the party. Not only is it class analysis – the “economic” categories that innervate it are immediately social and political forces; not only is its synthesis entirely oriented in the direction of a determinate political project, but, above all, its unique intervention on the problem of imperialism, in the ambit of the “classical” debate, 20 is able to tie together the actual moment of military conflict [scadenza bellica], that enormous tactical problem for the movement, with a strategic perspective marked by a precise vision, though here largely implicit, of the political composition of the working class within that entire historical phase. Precisely for this reason, of course, the reference to Lenin can only be critical. It is not by any means a coincidence, or a fashionable trend, that the theoretical-political debate on questions of imperialism has reacquired prominence in recent years, producing, if not the “definitive” work, a remarkable and growing number of interventions and sparks. 21 Indeed, we are dealing with a different composition of the global working class, utterly distinct from that of Lenin’s time, which consequently, in turn, critically examines the classics. This thematic revival has real and substantial effects, though only in some directions and despite (or perhaps precisely because of) a robust variety of approaches and viewpoints. There is, if anything, the question of why this revival of research has been so slow to appear, considering that in its main lineaments the world capitalist structure, as we have it before us, dates back at least twenty years, and actually shows itself to be entering into a phase of crisis and transformation precisely in this period. But it is a quietist and reactionary idea that a political or theoretical need finds a way of being satisfied at the correct moment in any case; moreover, a specific share of responsibility for the theoretical stagnation on the subjects in question is to be attributed, as we shall see, precisely to the “tradition” of thickheaded Leninism and of orthodoxy that still overwhelmingly blocks the terrain.

***

The first knot is therefore Lenin. There is an assessment of Imperialism from which it interests us to begin because it goes to the heart of the question, an assessment that views Lenin’s theoretical intervention as an unresolved combination of Fabian critique and enormous tactical drive. 22 One can show that each affirmation is, by itself, correct: their violent contradictoriness is indeed the problem of judging the popular outline.

One understands nothing of Lenin, generally speaking, if one does not start from the political objectives of his discourse, from its being determinate theory for a determinate practice. This has nothing to do with the legend of an empirico-practical Lenin. It has everything to do instead with Lenin’s general method – with the method of the sectarianism of workers’ science – the method of determinate abstraction, if one wants to call it that: to measure the tendency of capitalist development by the yardstick and from the viewpoint of a determinate revolutionary project in its rich complexity, the synthesis of which is the concreteness of the revolutionary rupture. 23 In this sense Imperialism is all in the method – is perfectly “Leninist.” The total working-class subject [soggetto operaio complessivo] – to which Lenin’s discourse is always “ascribed” – that establishes, against populism (or a certain populism), 24 the formidable analysis of the development of capitalism in Russia, following a line of theoretical work so seemingly opposed to that of Imperialism, is the same one for which the theory of the intensification of the (inter)imperialist contradictions, within the given phase, is built. The fact is simply that the overall world dimensions, which in that text indicate the inevitable hegemony of the capitalist relation over all of Russian society, are here terribly concrete – they enter concretely among the political variables of the ongoing subversive project. Any pacified “tendentialism” must therefore be shattered in the urgency of the rallying cry to transform the imperialist war into civil war. There is therefore nothing more absurd than, not only, to interpret Imperialism “in pieces” – to reduce it to a theory of capital export, to separate the economic explanation from the political one 25 – but to make of it a general-generic reconnaissance mission concerning a “phase” of the history of capital. Imperialism is first of all a conjunctural intervention [intervento di tendenza], and one of rupture, within the movement – it is anti-Kautsky. Therefore, on the other hand, Imperialism is necessarily part of October: in order to demonstrate that the project can “hold” – that a specific organizational strength of the Russian working class may be the weakness of global capital in Russia, the weak link.

But, on these points – concerning the “popular outline” (which is such due to its agitational function and certainly not because of its lack of depth or rigor in elaboration) as a great tactical initiative – all are in agreement. The real point is the other one: why can all this not be translated, except on backward, ambiguous, non-Marxist theoretical terrain, with “Fabian” analytical equipment, thus resulting in unsound and contradictory theory? Theoretical adequacy is necessary in Lenin: it would be absurd to have a Lenin who was “Machiavellian” in the vulgar sense. The war simply as an occasion will be, if anything, something in which extremists – and even before that, the right – cloak themselves. 26 But only the blind can deny that Imperialism is laden with contradictions. Let us quickly retrace its basic steps. The dynamic central connection, from the point of view of explaining the global structure of the system, runs through the processes of sectoral concentration and monopolization, especially in areas of heavy industry and in the accentuated international mobility of capital, both in a “direct” way on the basis of the needs of the vertical integration of production, and, especially, with the nature of portfolio allocation. As to the first aspect, the role attributed by Lenin to the wave of concentration and centralization that emerges in all the developed capitalist countries from the crisis of the 1870s until the first world war – as an overall qualitative leap of the system – establishes his discourse at a level historically coeval with the processes underway, radically beyond the terrain on which official Marxism in its various expressions had been engaged since the era of the Bernsteindebatte, not to mention, of course, the theoretical framework that political economy continued to offer regarding the cycle’s operation. Nevertheless, upon closer inspection, it is precisely the figure of monopoly, with the functional characteristics outlined in the academic literature of marginalism, that reappears in the Leninist analysis, with an inversion of perspective and position that does not, however, fundamentally alter its model of interpretation. 27 This has decisive consequences, in particular concerning the determination of the relation between concentration and processes of productive innovation that depend on it and determine it, and, in general, for the entire reading of the direction and meaning of the overall processes of restructuring-development, which are defined starting from the levels of concentration already attained in the era of the war.

As we have seen, the deepest economic foundation of imperialism is monopoly. This is capitalist monopoly, i.e., monopoly which has grown out of capitalism and which exists in the general environment of capitalism, commodity production and competition, in permanent and insoluble contradiction to this general environment. Nevertheless, like all monopoly, it inevitably engenders a tendency of stagnation and decay. Since monopoly prices are established, even temporarily, the motive cause of technical and, consequently, of all other progress disappears to a certain extent and, further, the economic possibility arises of deliberately retarding technical progress […]. Certainly, monopoly under capitalism can never completely, and for a very long period of time, eliminate competition in the world market (and this, by the by, is one of the reasons why the theory of ultra-imperialism is so absurd). Certainly, the possibility of reducing the cost of production and increasing profits by introducing technical improvements operates in the direction of change. But the tendency to stagnation and decay, which is characteristic of monopoly, continues to operate, and in some branches of industry, in some countries, for certain periods of time, it gains the upper hand. 28

If the reservations tellingly contained in a passage like this are overshadowed, and for good reason, when it is a matter of pinpointing the politically decisive characteristics assumed by the system in its specific imperialist configuration, they are not even invoked when the search for superprofits, cartelization at the global level, and the territorial partitioning of the world are all deduced to be typical counterfoils of the new phase of the total downfall of the system in the “era” of monopoly. The schema for explaining the relation between centralization and export of capital is rigidly underconsumptionist and repeats the Hobsonian line verbatim: the “necessary misery of the masses” and inevitable relative backwardness of agriculture restrict domestic investment outlets, in connection with the declining level of the rate of profit, and in relation to the prospect of superprofits on operations, speculative and not, on the international markets.

The ambiguity of an explanation, even with hesitations, that excludes the very possibility of a productive massification and, even before that, a leap in the organic composition of social capital permitted by the degree of monopolization reached, has consequences for an analysis of the new mobility of capital at the international level. The category “capital export” turns out in reality to cover over very different phenomena. If the multiplication of long- and short-term movements of capital (above all speculative) on the basis of differentials in interest rates and “special” conditions of allocation (public and semi-public loans, etc.) in the decades preceding the war, fits with Lenin’s interpretation of the phenomenon in the appropriated terms of “Finanzkapital,” this framework can hardly by contrast be deemed appropriate for that specific and important series of “colonial” activities restructuring production at the global level – in the sectors of raw materials, and old and new energy sources – in which the first figures of multinational business make their historic trial runs. 29 Here a rigid stagnationist interpretation prevents one from seeing, behind the falling rate of profit, the increase in the mass of profit; behind financial centralization, the enlargement and the real transformation of the industrial base that result from the great wave of “heavy” industrialization, which emerges between 1800 and 1900 in Europe and the United States, and of which the colonial partitioning is obviously an integral moment. And, on the other hand, conversely, the export of capital to the colonial world is well short of having the role that Lenin attributes to it, of propelling capitalist development to the periphery – this recognition will become one of the central themes of the subsequent literature on imperialism, oddly enough even for those who hold firm to the Leninist interpretation on the whole.

But we must examine the underlying theoretical structure of the line of reasoning in Imperialism. The category around which the analysis is organized is identified by a relation of divergence between processes which operate at the level of “productive” organization and the emergence of massive speculative-parasitic phenomena, on whose economic-political and ideological importance the strategic significance of Lenin’s intervention ultimately rests. Finance capital as hegemony of a banking oligarchy, of a class oriented to speculation and to income; capital export as swelling of social strata (even workers) who live by clipping coupons; imperialism as contradictory system of global domination on the part of a handful of rentier-states: this series of definitions specifies the theoretical and political axis of the popular outline.

It is characteristic of capitalism in general that the ownership of capital is separated from the application of capital to production, that money capital is separated from industrial or productive capital, and that the rentier who lives entirely on income obtained from money capital, is separated from the entrepreneur and from all who are directly concerned in the management of capital. Imperialism, or the domination of finance capital, is that highest stage of capitalism in which this separation reaches vast proportions. 30

And further: “Capitalism, which began its development with petty usury capital, is ending its development with gigantic usury capital.” 31

It is useless to underline the serious limitations of this formulation. Reducing the truly fundamental relation between money capital and industrial and productive capital to the process of the separation of the rentier is to place at the theoretical and political center of the analysis phenomena that, while certainly important, are ultimately secondary and derivative from the point of view of understanding the overall dynamic of the system. It is not an accident that subsequent bourgeois sociology, albeit with “apologetic” intentions, has deduced from the separation “of the ownership of capital from its application to production” exactly opposite general consequences 32 ; but it might perhaps be possible to demonstrate that, also in Lenin, the theoretical split between “ownership” and application, between money capital and industrial capital, contains within itself an ideological vision of capitalist entrepreneurship of a rather Schumpeterian flavor. Certainly what is raised is the problem generally invested in the category of “finance capital,” elaborated by Hilferding and utilized as such by Lenin. Indeed: the problem “finance capital” does not only reside in the undefined, “historically” transitory character of the specific relation (of domination) between bank and industry absolutized by Hilderding, 33 but, really, in the theoretical nature of the categories of money capital, productive capital, etc. – and most of all in the very conception of money – that underlie the Hilferdingian reconstruction, and in the economic-political functions assigned to each of them. 34 Even on the key point of the function of the investment bank within the historical phase of development considered by Hilferding and, in his footsteps, Lenin, the framework offered turns out to be not only qualitatively insufficient in some crucial aspects (relative to the role of the bank, of credit, of money capital in industrialization) compared to the historic reconstruction which we have today, but also a step backwards theoretically, compared to general indications and concrete models of analysis offered by Marx himself half a century earlier. 35

The figure that summarily characterizes the Leninist formulation is that of the rentier-state, denoting not only the position of a handful of states reigning over the entire rest of the world in the era of imperialism, but the overall “internal” nature of the metropolitan relation between state and capitalist development, and of its evolution. In this sense, if it is correct to consider Imperialism a politically necessary complement to State and Revolution, the complete superimposition of the two texts locks the general validity of the latter into a framework of specific references. In any case, it seems that this is one of the open problems which was mentioned, and which a strongly ideological, and moreover divided, discussion of the two thematic nuclei has kept in the shadows. What is, in Lenin, the relation between the thesis that the “rentier state is a state of parasitic, decaying capitalism” 36 and the theoretical reconstruction of the state capitalist machine that emerges from State and Revolution? Here, it is important, returning to the fundamental thread of our discourse, to underline the extreme rigidity of the Leninist formulation in Imperialism: domination by parasitical interests, tendency to stagnation, decay – these features irresistibly and irrevocably permeate the entire political and ideological superstructure of the state, up from the economic “base,” in the era of imperialism. To the radical and contemptuous liquidation of Kautsky’s “centrist” opportunism, there ultimately corresponds the almost complete acceptance of its opposite, which is Hobsonian tendentialism. The framework, as incredible as it is improbable, of the future effects of the global expansion of imperialism on the European metropolis itself, which Lenin adopts wholesale from Hobson, is significant in this regard.

The greater part of Western Europe might then assume the appearance and character already exhibited by tracts of country in the South of England, in the Riviera and in the tourist-ridden or residential parts of Italy and Switzerland, little clusters of wealthy aristocrats drawing dividends and pensions from the Far East, with a somewhat larger group of professional retainers and tradesmen and a larger body of personal servants and workers in the transport trade and in the final stages of production of the more perishable goods; all the main arterial industries would have disappeared, the staple foods and manufactures flowing in as tribute from Asia and Africa […]. The influences which govern the imperialism of Western Europe today are moving in this direction, and, unless counteracted or diverted, make towards some such consummation. 37

“The author [Hobson] is quite right,” Lenin comments, and adds: “if the forces of imperialism had not been counteracted they would have led precisely to what he has described.” But – and this is the point – in the overall logic of the popular outline, the meaning of that reservation is hardly specified through much analysis, which is nearly nonexistent, of the internal connection that ties the monopolistic and imperialist development of capitalism to the potentially new characteristics of the struggle of the working class – a connection that must qualify the political program and the program of power [il programma politico e di potere]. Instead, it is posed as the naked historical necessity of a total opposition – socialism or barbarism.

***

What is at the root of all this? What does not obtain is the relation between the political functions of the theory, with respect to the impending decisive moment [scadenza a breve] of the Russian 1917, and the global dimensions within which it must be validated. This, indeed, must never be forgotten: that if the axis of Lenin’s discourse is, as always, oriented toward the determinate tasks of the revolution against autocracy, 38 the war is a decisive moment [scadenza generale] for the movement – the party’s battle must be general and homogeneous (and in fact it is from the moment of the explicit rupture with Kautsky). Now, the theoretical impasse, and the practical tragedy, is simply that what appears on one hand as a weak link of capital, as the “organizational” strength of the Russian proletariat, should “logically” appear – if the theoretical referents are not altered – as the weakness of the global working class. The basic contradiction that dominates all others in the line of reasoning in Imperialism runs between the processes of ongoing capitalist concentration (and of centralization insofar as it is an instrument of the latter) assumed as the general theoretical base for interpreting the phenomenon, and the concept of the labor aristocracy, which is, paradoxically, the only outcome on the terrain of class composition.

The “stratum of workers-turned-bourgeois, or the ‘labour aristocracy,’ who are quite philistine in their mode of life, in the size of their earnings and in their entire outlook,” 39 is the strange fruit of the vast process of the concentration of production, of the increase of the scale of accumulation which also underlies and continually feeds the imperialist transformation of the system; and it is the extraordinary counterpart to the Leninist model – on which he gambles his entire political “career” – of the leadership [direzione] of the massified worker over the entire revolutionary process in the Russian subcontinent, in any case, of his holding fast to the workers in the factory, to their compact organization imposed by the very mechanism of the capitalist organization of work. 40 Naturally, the existence of phenomena of “upward” stratification with clear political functions is a recurrent fact and somewhat to be expected [fisiologico] in the history of capital, and Lenin, naturally, is well aware of this dialectic. 41 The disproportionate importance attributed to this stratum of the class in explaining the mechanism of a relative imperialist stabilization is not therefore simply the fruit of polemical passion.

It should be noted that behind this lies a material mismatch [sfasamento] in the levels of global capitalist development that does not get posed as an explicit theoretical problem. 42 In the concrete situation of the capitalist development of the Russian subcontinent, the very recent beginnings of the process of industrialization, its localized functions (and therefore technological levels and levels of the organization of work) and, in any case, its objectively limited dimensions, make the class of factory workers – even when it includes the most diverse stratifications of worker-figures, from the decayed artisan of the old manufacturing to the new “craft” [mestiere] worker – a compact mass, decisive spur of the revolutionary process, “political aristocracy for the occasion [materialiter],” as has been written 43 – whose program of power the “external” party had been founded from “afar” to serve. But at the level of the “advanced” countries, where, indeed, concentration can function politically as the first great historical massification, as liquidation of the entire old relation between worker and labor, the decisive function attributed by Lenin to a specific elevated stratum of the class is clearly an absurdity. The only real labor aristocracies are those on the defensive with respect to the processes of restructuring that the war itself powerfully incentivizes – they are members [base] within the international movement of the councils of a specific “left” ideology; and, furthermore, they are members in the subsequent evolution of the movement, a great part of the ideological baggage and the “tradition” of the Third International. 44

It is perhaps granting too much cunning to history and to Lenin’s own political intuition to project his dismissive judgment of the “aristocracies,” branded as a mere phenomenon of trade-union opportunism, onto these outcomes. But the fact remains that, on the theoretical terrain, in Imperialism this concept plays the role of falsely projecting onto capital those things which are clearly contradictions, limits, and delays of the organization of the class within the “advanced” areas of development – and, consequently, of reducing potential but actual phenomena of “integration” to the level of a merely ideological mechanism. But, even before that, the concept also “removes” contradictions and limits in the contemporary [for Lenin] Marxist theory of development. The tension – which is essential in Lenin, which is Lenin – within a general theoretical axis oriented in the direction of an insurmountable anarchy of capital, between the project of the party as a project of planning [progetto di piano] and the given possibilities of capitalist development in that phase, reaches the limit of its vitality. There the entire “collapsist” [crollista] tradition is renewed, for the first and last time, in the revolutionary sense – the war itself is, in fact, Zusammenbruch politics in action.

The subsequent sequence of events in the international class struggle – starting from the immediate postwar period – will lay bare the intensity, but also the extraordinariness, of the conjuncture within which Imperialism was conceived and in which it was really able to perform a formidable function for the movement. The political conditions changed, due to the very existence of the new workers’ power in the Soviet Union – and this will be the sole modification that the official workers’ movement will take into account on the level of “doctrine,” leading duly to rightward consequences 45 ; but the material conditions – the “model” – of capitalist development that Lenin had before him also changed, at least starting from the Great Depression 46 ; and, from there, consequently, the organizational needs and the contents of the program of the class struggle changed as well. This, above all, makes Imperialism’s limitations, in terms of its origins, both explicit and “true,” and makes it, unlike many classic writings (Lenin’s included), a work of its time. 47

2.

A lack of appreciation of the limits of Imperialism – certainly not due to simple, orthodox Talmudism – has represented a serious obstacle to an understanding theoretically founded on the world dynamics of the system, the absence of which is lamented today from all quarters. This is paradoxically also true for the viewpoint of bourgeois theory, to the extent that it wanted to test itself against the theoretical challenge of Marxism and was not limited to research, even if copious and useful, within a limited range. But here it is not worth retracing the “sites” [luoghi] of this economic and historiographic critique, which involves, to give some examples: arguments related to the historical non-demonstrability of immediate interests in support of operations of colonial annexation; the contestation that there exists a definite correlation between those operations and the quantity, direction, etc. of the flows of capital exports; attempts to demonstrate that the cost-benefit balance of (above all “direct”) relations of colonization sometimes resolve disadvantageously for the dominant countries; that the very “profitability” of foreign investment – at least from the point of view of the average profit rate, if not the marginal – is hic et nunc negative. 48 It involves, as even Bob Sutcliffe has demonstrated recently, 49 positions that unjustifiably flatten out Lenin onto Hobson (besides identifying colonialism and imperialism tout court); that fall systematically into the simple logical error of confounding levels of theorization and levels of simple generalization – it is one thing to construct a theoretical model that incorporates economic interests as decisive forces in imperialist dynamics, it is another to pretend to find in each empirical case the same sequence as the model. And, one can add, when they turn to theorization, they often prove to be incredibly vulgar – and we can justifiably include Schumpeter himself in this judgment. 50

But here it involves taking the argument back onto the other side, onto the line of the post-Leninist “tradition.” The judgment of it that is implicitly given, imputing to it a serious theoretical inertia, is based on the determination that it was nourished by a debate (when there was debate) about the validity of the Leninist theory completely abstracted from a class viewpoint – a debate, in other words, not “justified” by an independent [autonomo] analysis of new relations between class composition, theory of the cycle, and theory of organization. To argue in support of this judgment would mean retracing the entire history of Marxist theories on imperialism, starting from the 1920s, which is neither possible nor within the scope of this introduction. 51 But take a recent polemical exchange – which the reader will find documented in this collection – between Ernest Mandel and Martin Nicolaus: this, it seems to us, would serve as the best example. The subject, posed some years ago, is that of the new relations between the United States and Europe (and Japan) resulting from the boom, first of direct investments beyond the Atlantic, and second of foreign trade, over the course of the 1960s. 52 It resurrects a multitude of traditional questions and alternatives within the ambit of the theory of imperialism: super-imperialism versus inter-imperialist contradictions, commodity export versus capital export, wage differentials and productivity differentials, autonomy and “relative” subordination within the imperialist “chain,” and so on. But the exchange that one sees between the Trotskyist Mandel, apparent defender of Marxist orthodoxy on “economic” terrain, and the third-worldist Nicolaus, with his passionate reaffirmation of the political sense (of the politische Stossrichtung) of the Leninist model – resolves itself entirely within half-century-old categories (from finance capital to labor aristocracy), finishing in a bankrupt alternative between a political line that represents only an echo of “left” Gaullism, 53 and the fruitless invocation (fruitless “for us”) of a revolutionary collapse provoked by the peripheral proletariat. Nothing of what the 1960s has represented on the terrain of class struggle, on both sides of the Atlantic, seems to be present, if not as a remote backdrop and (this is true for Mandel) deprived of autonomous effect on the “objective” laws of capitalist development. But, moreover, even with respect to the latter, the discussion shows clear difficulties of formulation and leads to results which are hardly convincing, and at times contradictory. To cite a single point, the interpretation of the present crisis as a crisis of overproduction with respect to the dynamics of world demand – this is Nicolaus’s thesis 54 – would seem to agree with the picture drawn, conversely, by Mandel: aggravation of international competition, intensification of the forms of commercial and financial war, and so on.

But leaving aside the merits of this debate for now, it is important instead to extract from it a problem of a general character, which also runs through the essays in this collection (and in the most perceptive Marxist research in general), but which remains almost regularly avoided as such. 55 It concerns the possibility of founding, directly upon Marx’s theoretical corpus, the forecast of a process of the internationalization of capital that determines the existence, beyond the world market as an economic area of exchange between different countries, of a truly and properly global capitalist cycle – with the unity of cycles of production and circulation tending to eliminate the “economic” significance of the division of the world into nation-states. This is, for example, the problem already implicitly raised by the central Leninist argument of the new role played by the export of capital in comparison to that of commodities; moreover, it is the problem objectively posed by the current phase in the history of imperialism. That it is not a philological question should be obvious, and it would be truly strange to be deluded into thinking one might find some buried treasure between the folds of Marx’s texts, a ready-made theory of the dynamics of the world market. From this viewpoint, collages such as the one arranged for this purpose by Henryk Grossman fifty years ago can be considered preparatory work at best. His thesis on the merely extrinsic character of this “lacuna” can be countered effectively even on the philological plane: the succession of preparatory plans for Capital and the existence of the manuscripts rule out the possibility that Marx was never able to put his hand to the projected sixth book, or that he never thought to confront these problems in a systematic manner. 56 But this is clearly not the question. As the debate mentioned above demonstrates, the renewal of Leninism generally ends up being performed mechanistically, as a simple annexation of the subsequent changes that have intervened on the scene of international power relations to the schema of Imperialism. This proves more and more to be a fruitless operation. Instead it is a matter, if the formulation is permitted, of returning to Lenin by way of Marx. Today, renewing Leninist analysis in the political sense requires us to make this passage once again: to find in Marx, in his method before even in the contents of his discourse, the correct way (correct “for us”) of posing the question. In this case: what determines capital – as a political-material relation, as a relation of force – in its configuration and its international dynamics?

***

The constitution of a “world market” is defined by Marx several times as the greatest historical task of capital. This thesis is “established” already in the first pages of Capital: the analysis of the concept of abstract labor shows, in fact, that an infinite multiplicity of articulations is necessary to its historical-theoretical existence, a continual overcoming of the “limits set by use-value.” 57 Such an overcoming is possible ultimately only on the widest possible extension of the area of exchange, on the world market.

But it is only foreign trade, the development of the market to a world market, which causes money to develop into world money and abstract labour into social labour. Abstract wealth, value, money, hence abstract labour, develop in the measure that concrete labour becomes a totality of different modes of labour embracing the world market. Capitalist production rests on the value or the transformation of the labour embodied in the product into social labour. But this is only [possible] on the basis of foreign trade and of the world market. This is at once the pre-condition and the result of capitalist production. 58

Let us stop for a moment on this last point. How is it possible that a result is, at the same time, a presupposition? The explanation clearly must be sought in the mechanism, and the historical process, of “primitive” accumulation – in which, indeed, the Weltmarkt dimension is fundamental to Marx’s analysis. 59 Within it, “antediluvian” forms of capital – capital which, so to speak, has not yet become such – work ceaselessly to extend the borders of the world market, via the specific mechanism of accumulation that characterizes them – accumulation “durch Prellerei.” Precisely because its immediate source of profit is the earnings from the exchange – a gain which accumulates in enormous proportions in the “metropoles” of the system – mercantile capital is compelled to relentlessly extend the reach of the area of exchange, rather than its intensity. As Marx comments in Theories of Surplus Value:

Say, in his notes to Ricardo’s book translated by Constancio, makes only one correct remark about foreign trade. Profit can also be made by cheating, one person gaining what the other loses. Loss and gain within a single country cancel each other out. But not so with trade between different countries. And even according to Ricardo’s theory, three days of labour of one country can be exchanged against one of another country – a point not noted by Say. Here the law of value undergoes essential modification. 60

In what do these essential modifications of the law of value in its global operation consist? This is precisely the point which will need to be clarified. But the problem which is immediately posed is that of the relation between the Marxian illustrations of Urkapitalismus and the Leninist thesis of a gigantic “return” of world capitalist accumulation, in its mature phase, to its originary forms of movement.

It is undeniable that there is a strong analogy between the category of “parasitic” capital utilized by Lenin and the categories developed by Marx in his analysis of “primitive” accumulation 61 : in any case, the treatment of the relation between “economy” and “politics” is similar, between on the one hand the level of the social relations of production, and on the other the function of the state machine [macchina statale] in general. As, in the first instance, it sustains and protects, when it does not manage directly, the necessary process of the extension of the “market,” so, in the second instance, does it drive forward and safeguard the parasitic structure (parasitic to the second power) that the relation of production has gradually assumed on the global level.

The analogy is, for us, obvious. But the theoretical context within which that relation was interpreted is profoundly different in each instance. In Lenin there is an undeniably explicit intensification of the “putrescence” that the system undergoes in returning to its origins – this remains, as we have tried to show, the theoretical axis of Imperialism. On the contrary, in Marx, the atypical structure of “mercantile” accumulation has significance and “counts” exclusively on the basis of the emergence of the truly and properly capitalist relation – in particular, on the basis of the progressive destruction which it produces in the conditions of production and pre-capitalist social relations within the countries involved. The “presupposition” Weltmarkt dialectically inheres in its capitalistically progressive “result” – the coercive road inheres in the “natural” one. It should be noted that the question concerns the methodological structure of the discourse, and not immediately its contents. “Gigantic usury capital,” which returns, in Lenin, to dominate the scene in the greatest phase of the history of capital, may well be different in structure from that protagonist of the originary phase, but it is the demonstration of such a difference that is missing in Lenin, or which acquires inflections that are methodologically a long way from the Marxian model. But, moreover, one cannot clearly perceive in all of Marx’s own writings the coherent operations of the methodical schema exemplarily pursued in the analysis of primitive accumulation. And this is perhaps for reasons opposite to those just now indicated concerning Imperialism, due to a strict devotion not always justified in the contents of that analysis. This seems to be the case with Marx’s writings (and those of Engels) “on colonialism.” 62 In these there predominates a sort of linear “optimism” concerning the future effects of colonial domination in the countries subjected to capitalist “progress,” which they are destined to achieve via the same domination, through a rapid substitution of the capitalist mode of production for the ancient social relations of production. Of course, this optimism has been proven incorrect by subsequent historical events, but it is also not sufficiently founded on a specific analysis of the process. 63 It must be taken into account that – not unlike for the problem of the structure of accumulation in the late-joiner 64 countries, with which Marx will only seriously begin to concern himself in the final years of his life – the question of the internal effects of colonial annexation is absolutely secondary, in these writings, to that of the relation between modifications in the international framework of power which the annexations themselves entail, and the symptomatology of crisis at the level of the world market – to the relation that defines, in Marx’s head after 1848, the underlying conditions of the revolutionary process. 65

***

We now leave aside primitive accumulation and its problems, in order to try to delineate a possible Marxian model of the international movement of capital, starting from the full affirmation of its dominance, qua “industrial” (productive) capital, in the countries (or in the most important among them) that compete on the international market. Also, in this case it is necessary to proceed from certain, fundamental, methodological positions. Having established, as a matter of fact, the world market as “presupposition” and “result” of the process, the analysis must not from the outset be constrained to roaming around within the complex phenomenology that the empirical existence of such a market presents to observation. Under no circumstances is this its task.

In presenting the reification of the relations of production and the autonomy they acquire vis-à-vis the agents of production, we shall not go into the form and manner in which these connections appear to them as overwhelming natural laws, governing them irrespective of their will, in the form that the world market and its conjunctures, the movement of market prices, the cycles of industry and trade and the alternation of prosperity and crisis prevails on them as blind necessity. This is because the actual movement of competition lies outside our plan, and we are only out to present the internal organization of the capitalist mode of production, its ideal average, as it were. 66

Competition does not enter immediately into the methodical research plan – and this holds true for what unfolds on the international market. Naturally, the refusal to remain stuck within the phenomenal appearance exemplified in the above cited passages does not mean that such an appearance constitutes a type of inessential and mystifying veil, without any independent [autonomi] material effects. Its relation to the categories developed by the analysis is, in any case, dialectical. This is particularly true for the totality constituted by the international market. Another passage suffices on this point:

…their own exchange and their own production confront individuals as an objective relation which is independent of them. In the case of the world market, the connection of the individual with all, but at the same time also the independence of this connection from the individual, have developed to such a high level that the formation of the world market already at the same time contains the conditions for going beyond it.) Comparison in place of real communality and generality. 67

The determination of capital as an “ideal average” constitutes only a first moment of research, which must then move on to reconquer the concrete totality of the phenomenon (as “unity of many determinations”), following the theoretically and historically irreversible process of “transformation” of the figures that constitute it (the value of labor-power in wages, of surplus-value in profit, of value in price). Capital as “ideal average,” capital im Allgemein, appears only then in its real existence and as “social power.”

Capital in general, as distinct from the particular capitals, does indeed appear (1) only as an abstraction; not an arbitrary abstraction, but an abstraction which grasps the specific characteristics which distinguish capital from all other forms of wealth – or modes in which (social) production develops. These are the aspects common to every capital as such, or which make every specific sum of values into capital. And the distinctions within this abstraction are likewise abstract particularities which characterize every kind of capital, in that it is their position [Position] or negation [Negation] (e.g. fixed capital or circulating capital); (2) however, capital in general, as distinct from the particular real capitals, is itself a real existence. This is recognized by ordinary economics, even if it is not understood. 68

The reconstruction of capital as Gesammtkapital is precisely the purpose of the third book. Its kernel, as we know, consists in a schema of the distribution of surplus-value produced by the whole class of productive workers across the “many” capitals operating within a given social formation, conditional upon a profit which is tendentially equal for each (an “average” profit) and which is based on a difference in organic composition, continuously renewing itself, within and among the various sectors. 69 “Competition,” in general the coexistence of several particular capitals within the cycles of production and of circulation – in a word, the “market” – returns here to present itself, not as an “apparent movement” from which to abstract, but as an institutionally necessary moment of the system.

Now, the Marxian model just mentioned is valid within a social formation, within a “national” market. To what extent and in what sense can we extend it to the operation of the international market? Marx explicitly establishes, in the third book, that the level of abstraction is “determined” according to the viewpoint of the operation of a national capitalist society:

The distinctions between rates of surplus-value in different countries and hence between the different national levels of exploitation of labour are completely outside the scope of our present investigation. The object of this Part is simply to present the way in which a general rate of profit is arrived at within one particular country. 70

In spite of this, the applicability of this model to the international “market” has been considered possible at various times – recently by Christel Neusüss, with whose attempts we concern ourselves most of all. It should be noted that we do not mean to systematically organize the parts of Marx’s analysis that develop the essential aspects of such a market (and to which we will return), but which after all develop them from the viewpoint of the social capital of “a given country” (effects of foreign trade on the fall of the rate of profit, function of the international rate of interest on the movements of money-capital from one country to another, world money). On the contrary, we mean to establish, to put it simply, whether the global population, or better, all the social relations (of production) of developed countries participating in the world market, are constituted in a single social formation of a capitalist type. As we have said, attempts in this direction are not lacking – Henryk Grossmann’s remains important, but it has limited appeal today, due to the objective difficulty of anticipating developments which would happen at a later time, and due to Grossman’s aprioristic will to bend the line of reasoning to his dear thesis on the nature of crisis (always and exclusively as crisis of overproduction). Grossmann does not go beyond the “logical,” abstract dimension of the problem: if the decisive dimension of the capitalist Ausgleichung is the national one, it cannot at the same time be the international one, and, vice versa, if the latter is the case, the “capitalist homogeneity,” so to speak, of the national markets is necessarily fractured. 71

The more important difficulty remains, therefore – and it is easy to realize – the theoretical status that can be attributed to the functions of the state machine in general. Neusüss’s approach to this subject is as simple as it is suggestive. She gambles on the dialectical, so to speak, and moreover tendential character of the process of capitalist Ausgleichung. The very formation of a general rate of profit is, as Marx explicitly warns, a process “toward a limit”:

In theory, we assume that the laws of the capitalist mode of production develop in their pure form. In reality, this is only an approximation; but the approximation is all the more exact, the more the capitalist mode of production is developed and the less it is adulterated by survivals of earlier economic conditions with which it is amalgamated. 72

Now, the survivals of which he speaks in this passage can well be assumed within a general category of “frictions” in regard to competition, of obstacles to the full unfolding of its “equalizing” and concentrating effects. The state must be examined as an institutional “friction” vis-à-vis international competition, although naturally its function may be, and is in fact, the greatest stimulus to the expansion of the world market, precisely as its historical role has generally been that of organizing the unification of the domestic market. The coeval growth [concrescita], within historically very different but inextricable forms, of its specific political-institutional (as well as directly “economic”) functions within capitalist development, makes the state machine an ineliminable component of the operation of the international market. It is responsible, as we shall soon see, for the irregular, and moreover incomplete, validity of the law of value. It is worth returning to a long passage that synthesizes the fundamental themes of Neusüss’s approach:

Capital constitutes itself as total social capital in relation to the many individual capitals by means of competition. But it cannot by itself actually accomplish this process of constitution if the State does not put into place, in relation to the historically given situation, all the general conditions – be they material, juridical, or political in the strict sense – which particular capitals, precisely by their nature, cannot establish. In their origins and national character, the juridical relations that regulate the circulation of capital, as a reflection and control of the mutual relations between owners of commodities, establish the true and proper separation between national and world-market circulation. In fact, circulation in the world market is regulated through and through by the dispositions of state institutions, and, in fact, there exist precarious contractual relations that express the tendency of capital to drive forward the world market, as the totality of particular capitals, in the sense of a real total capital; but in contrast to within the State, here there is always the possibility that economic relations will degenerate into relations of plunder, deception, and open exploitation. This is not sufficient; the real national existence of the State as representative and collector of single national capitals is further clarified here insofar as theft is always mediated by the State – it is, as a rule, carried out with the deployment of state power. In these cases the function of the national State is completely exposed: facing inward, it guarantees the social existence of the plurality of individual capitals; facing outward, it can implement a politics that diametrically contradicts the political unification of various national capitals into a total global capital. This is because it offers to the counterposed interests of national capitals in competition with one another a political form against which it can fracture the validity of economic laws on the world market. 73

Before following the next development of this formulation, it is necessary to make some general critical observations. It is, indeed, a formulation that wants to hinge itself on the Marxian schema already recalled, of the transformation of capital from simple relation of value (surplus-value) to social capital, but which, in our view, does so in a rather mechanical manner. The process of the constitution of capital into social capital actually ends up being identified with the sphere of the real and perfect validity of free competition. Certainly, the Aufhebung of the “frictions” of free competition should not be understood as a neoliberal, anti-monopolistic 74 postulate, but as a result of the specific function performed domestically by the state in validating the purity of the capitalist law of accumulation. But what exactly is that law? And above all, what forms does it assume today, at a certain historical level of maturity? The limit of Neusüss’s approach, on this score, is twofold: on the one hand, her reconstruction of Marx’s analysis tends to reduce the scope within which he has relevance to an historical range, one which is, after all is said and done, limited to the epoch of “competitive” capitalism; and, on the other, she then aspires to extend that same reconstruction, unaltered, into the present. Here it should be noted that she is not dealing with the problem of the monopolization of the economy taken in itself. Naturally, she has taken into account the process of concentration; but for Neusüss, such a process, despite being a necessary consequence of the laws of capitalist accumulation – which in fact correspond to it – is not subject to generalizations, as it unfolds within a rather different historical particularity of the state-capital relation (within an always different “historischen Milieu”). Essentially Neusüss reduces monopoly to a transformed form of competition. This is, in fact, a correct operation, provided that one abandons the objectivistic perspective that is, instead, her signature, and provided that one reads the categories of competition, monopoly, and so on for what they really mean in Marx. 75 From the objective economic point of view, monopoly is the exact opposite of competition. The continuity, which is so dear to Neusüss, 76 of the capitalist relation and of the operation of its laws even when free competition has become a faded historical memory, is significant only as the continuity of domination, and, concurrently, as the result of the permanence of the class struggle. Not even the dialectic between the particularity of single capitals and social capital seems to be an essential objective feature of the system today – as the saga of really-existing socialism shows.

This type of recuperation, too rigidly loyal to the letter of Marx’s texts, has some very respectable motivations: throughout the discourse, there is a continuous polemic, whether implicit or explicit, with the “Theorie des Staatsmonopolistischen Kapitalismus,” the interpretation of current-day modifications in the state-capital relation, which Neüsuss finds intent on legitimizing the most opportunistic praxis [prassi] of the workers’ movement in the West – “theory” which has been developed especially in the milieu of the GDR and of official German and French communism, of which we cannot concern ourselves here. 77 But it does not really seem as though the barrage launched by Neusüss from the trenches of Capital, or, better, her reading of Capital, constitutes an adequate reply. The litmus test, even in this case, is the question of the state. On this point Neusüss’s vision is perfectly complementary with what has been said so far. Once and for all, one hundred years ago as well as today, the state is an organized apparatus [apparato organizzato] which, from a position outside and above, prepares and guarantees the external conditions for capitalist development – conditions which are material (“infrastructural”), juridical, and political. The state is neither more nor less than a function of the social development of capital, and an external function: it is, as a rule, subject to the accusation of only performing unproductive labor. The antinomic character of the capitalist social relation does not operate dialectically within the political-state form [la figura politico-statale]. Neusüss appeals to the authority of Pashukanis in vain; her Pashukanis is that of Kelsen and of revisionism in general, the Pashukanis of “all law as private law” and of the dullest institutionalism. 78 Down this road, not only does one fail to grasp the character of today’s crisis of the state, which is a crisis of its overall attempt to re-qualify itself as direct planner [pianificazione] of development, but one remains on this side of that fundamental historical experience. 79

***

But we return now to the main thread of the argument. The hypothesis that has emerged is that of an anomalous structure of the world market, and, moreover, a structure which cannot be assimilated to that of the domestic market, because of the intermediation of the state. In the domestic market the modern state, rather than being an obstacle, has precisely the task of removing obstacles, and of constructing the conditions for a “normal” unfolding of the process of capitalist Ausgleichung. Marx is explicit in indicating these conditions:

This constant equalization of ever-renewed inequalities is accomplished more quickly, (1) the more mobile capital is, i.e. the more easily it can be transferred from one sphere and one place to others; (2) the more rapidly labour-power can be moved from one sphere to another and from one local point of production to another. The first of these conditions implies completely free trade within the society in question and the abolition of all monopolies other than natural ones, i.e. those arising from the capitalist mode of production itself. It also presupposes the development of the credit system, which concentrates together the inorganic mass of available social capital vis-a-vis the individual capitalist. It further implies that the various spheres of production have been subordinated to capitalists. […] A final precondition is a high population density. The second condition presupposes the abolition of all laws that prevent workers from moving from one sphere of production to another or from one local seat of production to any other. Indifference of the worker to the content of his work. Greatest possible reduction of work in all spheres of production to simple labour. Disappearance of all prejudices of trade and craft among the workers. Finally and especially, the subjection of the worker to the capitalist mode of production. 80

Now, the active role of the state in determining or allowing the realization of this twofold condition is transformed, up to a certain point, in the world market, into the role of institutional intermediation and therefore into an obstacle, actual and potential, to the completion of the process.

The institutional character of this intermediation should be underlined: it does not depend exclusively on particular state “policies” on the terrain of international exchange. Thus, incidentally, the fact that the international arrangement is to this day reconstructed as a mutual regulation, in principle, between states, and that the effective juridical regulation of international exchanges has a basis, either in a pact or deriving from a unilateral state determination 81 – all this, to take an example, is not simple ideology. If anything, it is an ideologically “real” reflection of the situation. Single capitals, not (exclusively) states, remain the real subjects of the world market. But, indeed, the imputation to the state of all foreign trade and the subsequent outstanding debt and credit registered by the balance of payments – these are not simple accounting expressions, but instead confirm the specific nature of this market.

What is, therefore, the theoretical model within which to comprehend its operation? Judging from some hints, even if they are incidental, Marx himself seems inclined toward reusing the schema of “simple mercantile” production. Discussing, in the central tenth chapter of the third book, the “equalization of the general rate of profit,” Marx “supposes” at a certain point – in order to bring out the heart [punctum saliens] of the problem – a situation in which the workers themselves are the owners of their respective means of production. In this case, the exchange of products that contain a different ratio of living labor to dead labor takes place approximately, but directly, in terms of value.

Under these conditions, the difference in the profit rate would be a matter of indifference, just as for a present-day wage-labourer it is a matter of indifference in what profit rate the surplus-value extorted from him is expressed, and just as in international trade the differences in profit rates between different nations are completely immaterial as far as the exchange of their commodities is concerned.

And he continues:

it is also quite apposite to view the values of commodities not only as theoretically prior to the prices of production, but also as historically prior to them. This applies to those conditions in which the means of production belong to the worker, and this condition is to be found, in both the ancient and the modern world, among peasant proprietors and handicraftsmen who work for themselves. This agrees, moreover, with the opinion we expressed previously, viz. that the development of products into commodities arises from exchange between different communities, and not between the members of one and the same community. This is true not only for the original condition, but also for later social conditions based on slavery and serfdom, and for the guild organization of handicraft production, as long as the means of production involved in each branch of production can be transferred from one sphere to another only with difficulty, and the different spheres of production therefore relate to one another, within certain limits, like foreign countries or communistic communities. 82

We now understand the reasons for Marx’s assertion, cited above, that the law of value undergoes “essential modifications” on the international market. These terms are not chosen randomly. Because of its separation along national-state lines, international society is not capitalistically homogenous – it does not exist as a capitalist society. The law of value is not transformed here into its opposite – law of surplus-value and then of profit – but applies as such. It applies as law of exchange of equivalents, but with this essential modification: while inside a country the capital gains produced must be mediated by exchange, although they cannot arise from it, since there is a necessary offsetting of “unequal” exchanges, in the sphere of international trade there is the possibility (but then there is no other possibility from circulation) of systematically transferring value from one place to another, from one contracting party to another. What is then the mechanism which, on the one hand, maintains international exchange of commodities as exchange of equivalents, according to the law of value, and on the other hand, determines it as unequal exchange? Marx mentions it explicitly in the neglected chapter in the first book dedicated to the “difference between national wages.” He writes:

In every country there is a certain average intensity of labour below which the labour for the production of a commodity requires more than the time socially necessary, and therefore does not count as labour of normal quality. In a given country, only a degree of intensity which is above the national average alters the measurement of value by the mere duration of labour-time. It is otherwise on the world market, whose integral parts are the individual countries. The average intensity of labour changes from country to country; here is it greater, there less. These national averages form a scale whose unit of measurement is the average unit of universal labour. The more intense national labour, therefore, as compared with the less intense, produces in the same time more value, which expresses itself in more money. But the law of value is yet more modified in its international application by the fact that, on the world market, national labour which is more productive also counts as more intensive, as long as the more productive nation is not compelled by competition to lower the selling price of its commodities to the level of their value. 83

“In a given country,” therefore, all labor is reducible, and is reduced in fact, to “normally” productive labor; more generally, in a given country, competition works not only on the “products” but on the very “factors” of production, pushing capital and labor into more and more productive sectors. On the international market, however, this second type of competition is blocked, or forced to operate in a partial and mediated way, by the modifications that are established within the various countries between the relative costs of various productions. The national levels of intensity and productivity of labor are modified mainly for reasons relating to internal development: these are arranged on a “scale” whose unit of measure is a simple arithmetic average. “Normal” international labor does not exist anywhere in reality. 84 Therefore the daily laboring of a more productive nation does not only produce more wealth but, proportionally, more value – and it swaps places with a proportional multiple of the working days in less productive countries. This means – as we have seen in the Ricardian schema, or, better, in the schema from which Ricardo develops his theory of international specialization – the presuppositions are, after all, the same. 85