The “offshoring” to the Third World of certain basic industries of the major capitalist countries, and the whole operation commonly referred to as “technology transfer” (the sale of industrial equipment, licenses, patents, know how, “turnkey” factories or factories with “produced in hand” contracts1) have been the subject of an abundant literature for several years. Most studies focus on trends in the international division of labor, the internationalization of capital and certain production cycles, and the “offshoring” of large multinationals. On the other hand, the concrete functioning of those industries which have been “offshored” or set up by “transferred technology” in Third World countries has hardly been studied in a systematic way, and we only have scattered and disparate data on this subject. It is regarding this concrete process that we would like to make a few remarks.

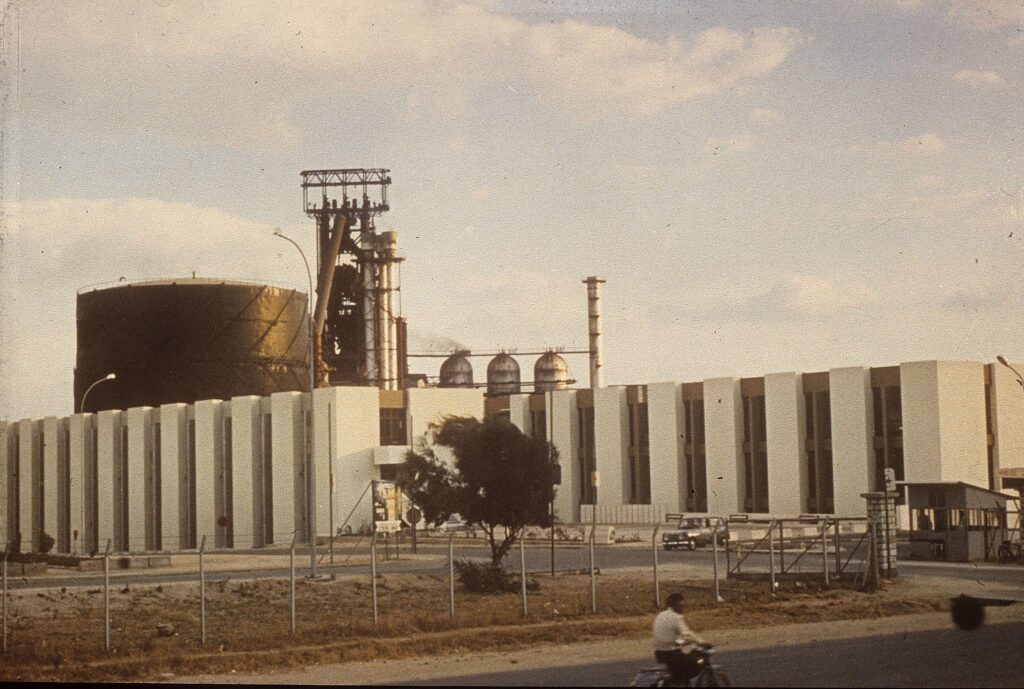

The following comments are essentially based on a research trip to Algeria in April 1974 at the invitation of the general secretary for planning. During this trip, several production units in eastern Algeria (the Annaba region) were visited, where the steel industry in particular is concentrated. This area is considered by Algerian planners as a major or even the principal “pole of development.” This trip also involved a trip to the city of Guelma, a secondary point of development in the same region.

Two facts were overwhelmingly evident during this trip. First, the reality of the Algerian industrialization effort. To an observer who rediscovered this area some ten years after his previous visit, the physical transformation of the landscape was striking, as was the emergence of a new generation of young executives vigorously engaged in the problems of technology and the organization of production.

But the other salient fact was the underutilization of newly purchased industrial equipment. Out of the four factories we visited, two were completely stopped due to supply chain disruptions, one was partially stopped due to technical incidents, and only one was functioning normally:

– The SN Metal unit in Annaba, a medium-sized factory producing wheelbarrows and towing equipment, was operating normally

– The hot rolling mill of the El Hadjar steel plant (Annaba) was halted by a technical incident;

– Production of the very modern chemical fertilizers plant of Annaba was stopped for lack of sulfur supply

– The ceramic factory at Guehna was stopped for lack of supply of imported feldspar.

The only factory to function normally, SX Metal was also, out of the four units visited, the only old factory inherited from colonization – all the new installations that we visited were in poor operation. This is an observation made without any statistical value, of course, but the magnitude of which excludes mere coincidence. All the more so, since our interlocutors reported similar difficulties in other factories in the region. These facts drew our attention to the problem of supplying newly imported industries, and generally, the problem of inserting industrial complexes purchased abroad on turnkey contracts or otherwise into a determined socioeconomic space.

The so-called ”technology transfer” problem is currently the subject of broad discussions. A “symposium” was devoted to it in Algiers in October 1973: the resulting report contains particularly interesting communications from representatives of the Algerian National Companies. It is now commonplace to point out the multiple difficulties which arise in factories bought by newly independent countries from “engineering” companies: significant delays in setting up production – which sometimes never reaches the expected level; frequent stoppages and unforeseen difficulties of all kinds. Some countries purchasing equipment are trying to overcome this obstacle by refining the contracts: contracts “produced in hand” instead of “turnkey” contracts; more precise penalty clauses in case of delays or malfunctioning, etc. However, this legal aspect of technology transfer often remains a dead letter to the extent that the relations of power are unfavorable to the buyer. The seller evades the penalty clauses by blaming all causes for delays on the buyer, and the buyer often hesitates to apply penalties for fear of open or camouflaged retaliation. The complexity of the blockages resists simple contractual precautions.

Some of the difficulties arise from causes internal to the imported production unit: production methods may turn out to be ill-suited to work habits and to the training of local labor; there is a lack of specialists and technicians; in some cases there is even a phenomenon of withholding information on the part of the “engineering” firm which, although it has undertaken to do so, does not reveal all of the manufacturing secrets …

However other causes of the blockages must be found in the totality of the economic and social environment, and the existing structure of global markets. We will now focus on this point.

It is still possible to reproduce in North Africa an exact imitation of the buildings and machines of a specific chemical factory that is currently operating in France or West Germany. But it would be an illusion to believe that we will find the same factory in Africa, simply because the plans are identical. A seemingly similar production unit functions very differently when it is located in different socioeconomic spaces and linked to different communication systems.

Modern heavy industry of the capitalist countries is today increasingly based on rapid circulation and large-scale raw material, semi-finished and finished products. This is a relatively new situation, which took shape a few years after World War II. This is due in part (and we insist on this in general) to the emergence of transporting giants which have greatly reduced the cost of freight shipping, which has disrupted the transport economy and profitability calculations in procurement policy. But it is also determined by other factors, notably the strategy of capitalist heavy industry groups, eager to use foreign trade on a massive scale to shatter internal monopolies, including those held by their own working class – especially those held by miners. Supply diversification appears as a guarantee vis-à-vis suppliers and as a weapon in case of social tension.

This trend has increased with the instability of the major world markets and the diversification of speculative mechanisms. In intensifying their foreign trade, steelmakers or chemists who “go to sea” or work with major communication routes are trying to guard as much profit as possible from abrupt fluctuations in world markets, particularly as concerns raw materials and standardized semi-finished products. This policy also puts them in a position to seize, at the lowest cost, any major technical innovation which involves changing the combination of factors of production: substituting gas for coal, one type of ore for another, etc. It should be added that these major industries generally operate continuously and that in some cases a production shutdown can result in rapid deterioration of facilities: adding another incentive to ensure the regularity and security of supply by facilitating its arrival and diversifying its origin.

For all these reasons, this type of basic industry currently requires special attention to relations with the outside world. In developed capitalist countries this requirement is met in a complex way:

– development of large industrial port zones and important road communications infrastructure, waterways and railways;

– dense telecommunications networks and systematic use of computers (keeping the order book, programming production, managing stocks, etc.; the complexity of the system is such that at the time of the merger of the two large French steel firms De Wendel and Sidelor in 1967, it took more than a year of efforts to unify their information systems and main management mechanisms);

– development of an increasingly complex system for the commercialization and circulation of capital; the growing role of commodity markets and commodity exchanges, all the more difficult to penetrate now that we see the development of increasingly speculative methods, whether it is a matter of raw materials, scrap metal, or basic petrochemical products.

It is by taking advantage of this whole system that the basic industries of the capitalist countries guarantee their regular functioning and their place in competition.

It is clear that the large heavy industrial units of the same type implanted in North Africa for instance find absolutely none of this infrastructure and environment, which correspondingly modifies their functioning and their competitiveness. We can verify this through the following two points:

1. The Ports

Fundamentally, Algeria is rather well endowed with ports. But the potentialities of the Algerian port system are, at present, (and despite recent efforts at improvement) only partially exploited. Efficacy is limited on the one side by physical impediments, on the other hand by irrational management. In terms of equipment: there is a lack of lifting, unloading, and pumping instruments, as well as of means of storage. Generally, this shortage of port equipment limits the use of the most convenient methods – for example the bulk transport of a whole set of products. In terms of management: transit of goods at the port is usually very poorly organized. Thus, there is no provision for any form of penalization of National Companies for excessive delays in taking charge of goods at the docks: hence, they tend to use the port as a temporary storage place for goods that they do not immediately need. Hence the congestion of the docks, an aggravation of the storage shortage. Waiting times for boats are lengthened before unloading, and some urgent supplies cannot be unloaded on time. There is a very slow turnaround of ships, a general scourge of Third World ports. It has been estimated that traffic jams – that could be avoided by simply rapidly removing goods stored at the dock – on its own reduces the capacity of the port of Algiers by 20 to 30%! A commission of inquiry on the port of Algiers recently drew up a heavy toll of the financial losses caused by overcrowding, and revealed real scandals: a small imported production unit had been forgotten on the port for a year and quietly abandoned machines rusted without anyone coming to look for them.

Added to this is the fact that the secondary ports (e.g. Ghazaouat, Mostaganem, Ténès, Dellys) are underutilized, all traffic being concentrated on the three main ports: Algiers, Oran, Annaba. According to Algerian statistics, Algiers alone recorded in 1970 more entries of goods than all the other Algerian ports. In large part, it seems, for reasons of administrative centralization.

All this difficult operation of the port system has, of course, a direct effect on the cost of freight, burdened with heavy demurrage.2 More seriously: in the event of tension on the freight markets, it happens that the shipowners of the capitalist countries outright refuse to send their boats to the so-called “underdeveloped” countries, preferring to make full use of their fleet between highly mechanized ports and thereby avoid problems: in Rotterdam, one can be sure that a boat will not wait more than 48 hours. Thus, in Algeria in 1974, one could see factory managers lamenting the blockage of their production because purchased cargo remained in Marseille or elsewhere awaiting transport. Conversely, when the freight market is depressed, shipowners may find it advantageous to come and cash in excess at a particularly congested port: this policy recently turned into a scandal in Lagos, forcing the government of Nigeria to take radical measures against a veritable armada of boats of all origins who tranquilly profited from a massive traffic jam they had caused …

Costly and irregular freight: insecurity of supplies, subject to the vagaries of the arms market. Here too, the balance of power is often unfavorable to Third World countries and the law of profit is difficult to thwart. The capital markets for sea freight are highly oligopolistic, with the organization of “shipping conferences” between the various companies on the main lines. Faced with this cartelization, it is very difficult for an isolated country, particularly when its port equipment is poor, to defeat the “diktats” of shipowners. It even happens that shipowners who have a monopoly on certain types of transport (for example transport of grain or refrigerated transport) are in a position to de facto prohibit certain trade between distant Third World countries, if this trade is an obstacle to interests with which they are linked.

It is because of these conditions that Algeria is trying to gain a certain autonomy in maritime transport, by building a large national fleet; in particular, it has been acquiring LNG carriers for the transport of its natural gas.

A situation of dependence and insecurity remains in place, which seems difficult to overcome immediately. The disadvantages of imported and remaining technology, highly dependent as it is on external supplies, are thereby multiplied. It is not difficult to imagine the consequences of the irregularity of supplies on large heavy industrial plants designed according to the criteria of functioning of developed capitalist countries, and thus involving major daily physical flows: supply difficulties in raw materials, spare parts, supplies of all kinds; very high cost of transport – all these are factors which contribute to raising the costs of production and constitute serious handicaps in competition on a world scale for the industries involved.

But the most immediately obvious direct effect of these difficulties has already been noted: the very irregular operation of recently imported plants.

2. Commercial Structures

The global trade structures that govern part of the supply further complicate the situation. The markets for raw materials and standardized semi-finished products (common steels, basic petrochemicals) are currently largely dominated by speculative mechanisms. In these markets, capitalism has many weapons: rapid decisions, secret trade, safe intermediaries, interconnected networks of interests, dumping, etc. By these means, it maximizes its exploitation of the rapid flow of capital and the concrete conditions for the realization of value.

Multinational corporations are obviously well placed to engage in successful operations under these conditions, especially since they themselves play a large part in creating these conditions. On the other hand, Third World countries are often in a state of inferiority from the point of view of the commercial system, purchasing techniques, and procurement procedures. We could cite many examples of failed transactions or transactions carried out on the most unfavorable terms, for lack of precise knowledge of the markets, or because of the excessive length of negotiations or procedures, or even because the dilution of powers delayed decision-making.…

At a deeper level, certain oligopolistic practices on the large capitalist world markets are deliberately closed and hermetic to the countries of the Third World.

Thus, the price of steel is worked out by complex calculations, the Brussels Stock Exchange indicating a trend from which we calculate the “extras” (premiums specified by product), the average of which is given regularly by the Metal Bulletin in London. But this is only an official base, established from known markets. However, a good part of the negotiations is secret, and the prices are established largely by direct relations, insofar as the seller and the buyer are two large economic subjects. When Thyssen sells steel to Volkswagen or Usinor to Renault, the prices and content of the contracts are hidden from publicity. A first difficulty for the steel industry in a Third World country: how to price its products (or buy semi-finished products used in the production process) when it is not directly involved in cartelization? Hence, the common temptation for the leaders of these new steelworks to bind themselves to this or that dominant force of the capitalist system, which never happens without an increase in dependency.

We can mention another factor of obscurement of exchanges and prices: triangular arrangements and the practice of “clearing.” A country delivers so many tons of sugar in exchange for a turnkey factory, and since the two are not equal, 50,000 tons of steel is added to the factory. This is common practice, and it is difficult to estimate the exact price of each component of such global contracts, some of which are, moreover, very complex and diverse. This constitutes an additional obstacle to controlling supply policy.

The world market often functions as a set of cogs and gears, which increasingly pushes the infant industries of the Third World towards working for external demands and the extroversion of the economy. In the case of heavy industry, oversized steelworks projects, inspired by profitability criteria currently in force in the developed capitalist countries, are part of this same trend. The commercial aggressiveness of countries or firms attached to developing their trade with the Third World accelerates the process. So it was with Japan, there a few years ago, bought cast iron from Algerian steelworks: shortly after, Japanese firms delivered to Algeria a giant steelworks “turnkey” project, said to be following the spirit of “rebalancing exchanges” (buying before selling is, moreover, the systematic policy of Japan in the Third World).

These then are the concrete conditions in which the new imported production units are connected to the global system. Some of the sticking points have been noted. Many others could be cited. The result remains that the extroversion of units – while it can have favorable consequences from the point of view of profitability in the developed capitalist countries – constitutes on the contrary, in the Third World, a serious danger. “Technology transfer,” as currently practiced, does not in any way guarantee the transfer of the operating conditions of the “technology” in question.

Does this mean that the newly independent countries must give up industrialization? Obviously not. Their true industrialization is essential to ending relations of dependency. But one of the conditions of true industrialization is indeed becoming not to copy large industrial units established by capitalist enterprises in the logic of their struggle on the world markets. It is up to each country of the Third World to find its own form of industrial development, at the level of production, productive methods, and types of most suitable products. It is also important to pay the greatest attention to the effective functioning of the production units put in place, so as not to install a technology that is unsuitable for integrating into the existing socioeconomic structure.

The existence of multiple blockages in the functioning of large recently imported industrial units currently constitutes of the essential problems to be solved for the Algerian authorities. The place and modalities of “technology transfer” and more generally the politics of the “poles of development” (theorized under the name of “industrializing industries”) have been the subject of many of the debates which, since 1975, have accompanied the implementation of the second four-year plan. Should we continue focusing nearly 80% of investments on three limited regions, risking thereby accentuating the exaggerated growth of these regions and the disarticulation of the economy as a whole, or should we distribute them in a more egalitarian fashion across Algeria’s territory? Must we continue to buy the most modern “technology,” or should we resort to more rustic methods of production whenever possible?

The turnaround in the world economy precipitated this crisis of conscience amidst the leaders of the Algerian economy. The euphoria of 1974, triggered by the quadrupling of the price of crude oil, was followed by a sharp drop in oil sales and revenues. The bloated purchasing programs and investment plans had to be hastily revised downwards. But quantitative reductions do not solve anything – they can even exacerbate some imbalances or bottlenecks if they are applied too abruptly. The severity of the basic problem becomes all the more pressing.

Which path will Algeria take to try to overcome these blockages? Basically, two possibilities exist and the realization of one or the other depends in the last analysis on the evolution of the sociopolitical balance of power within the country.

The first option – probably the most likely in the near future – is the pursuit of the “poles of development policy” and systematic import of equipment corresponding to the technology of the developed capitalist countries, despite the difficulties encountered. But these difficulties are too serious to be able to continue as if nothing had happened. Either way, attempts will have to be made to overcome or reduce the incidents and bottlenecks described above.

That is why “rationalization” of the management of National Societies will probably be invoked, a “rationalization” which would introduce capitalist criteria of operation, thus reducing central state control. The managers and executives of these production units are pushing strongly in this direction. Most often from the Algerian urban bourgeoisie, generally trained in Western universities and strongly influenced by the technical ideology of the large capitalist countries, they constitute a coherent and determined force; they complain of what they call the “bureaucratic straitjacket ” and call for greater freedom of movement in the management of their units, hoping to become increasingly autonomous. They criticize the cumbersome administrative procedures of procurement, the complication of customs controls, transportation difficulties for spare parts, etc. They guarantee their capability of securing much better results and of operating the industrial facilities under their control more regularly, if allowed free access to global markets and the removal of all the barriers currently established by central government control – even if it means subjecting them to a posteriori control.

A first step was taken in this direction in 1974, with the National Societies awarded block grants for purchases abroad, with freedom of action within specified limits (still relatively narrow).

If this trend continues (and the conclusions drawn from the first four-year plan seem to indicate it), the Algerian National Companies, which already concentrate most of the technicians and executives, and a good part of the qualified labor, as well as a determinant part of available financial resources, will behave increasingly as autonomous economic entities, connected to the global market but gradually isolated regarding the Algerian hinterland.

Various factors accelerate this process of empowerment: the circulation of technical information and of “experts” in the world of large modern industrial units conveys a whole ideology which accentuates the specific features and the cohesion of the technical and economic “elite”, facilitating its integration with its counterparts from other countries. Similarly, the management of the labor force tends to reproduce the organization of labor operating in the developed capitalist countries: the gap is widening, there, between executors on the one hand, executives and managers on the other. Language itself acts as a barrier: the laborer and the dock worker think and express themselves in Arabic – sometimes ignoring the French language; the plant manager and the engineer speak French and are immersed in European culture.

Is the regular operation of units assured? While such a process of increased autonomy could initially reduce certain blockages, it is not at all certain that it will solve the overall problem in the long term. The increasing integration into the world market could prove to be a trap for the units that are fundamentally disadvantaged by the lack of infrastructure and an industrial fabric comparable to those of the developed capitalist countries. Conjunctural reversals and sudden fluctuations in major markets will weigh a much heavier weight on the marginal fringes of a globally interconnected industrial system: every crisis hits them first, and with full force.

However, another way is possible. If a disruption of the current balance of social forces pushes the political forces in power to slow down this excessively dangerous process – or transforms these forces in power themselves – it could be put into action. In the disadvantaged “wilayas,“3 where “special programs” are granted piecemeal to limit surges of discontent are far from solving the problems of unemployment and poverty, constant pressure by the population in favor of more balanced development is manifest. The mass of the peasantry would like more equality in the distribution of financial resources, productive equipment, and infrastructure works. It has a dim view of the growth of hypertrophied urban centers and the emergence of privileged islands of consumption. This pressure is expressed in certain spheres of the state apparatus and political power, where occasional populist reflexes and a certain ascetic ideology come up against the demands of rising technocratism. The waste that accompanies technology transfer operations provokes reactions. As far as we can tell, these reactions are nonetheless in the minority.

It is conceivable that, following the acceleration of sociopolitical tensions, a breaking point could be crossed, new alliances could be forged within the social formation, and a certain number of choices could be called into question. The strategy of “poles of development” would be limited to the benefit of a more balanced development; investments would be distributed in a more diversified way between sectors of the economy, regions, and types of production units. Attention would be lent to the possibilities of creating small- and medium-sized units, more strongly connected to their immediate environment, both as a market and as a source of supplies. More generally, one would make as the objective internal coherence of the national economy, by relying mainly on the relations between industry and agriculture. A halt would be made on the excesses of the import of foreign technologies: greater selection in contracts, efforts to develop national technology – even those which are less “modern” – whenever possible, systematic use of local reserves of labor when they can avoid the importation of “capital intensive” techniques and materials manufactured abroad.

Can such a change of direction be achieved without profound upheavals? One cannot answer in the affirmative, especially since the interests grouped together in the first position (pursuit of the policy of “development poles” and the empowerment of large units are gaining in power and confidence. Their chance of promoting this path without a regime crisis depends on their ability to limit its immediate social cost. A difficult goal to achieve: eastern Algeria, which concentrates most of the recent industrial investments remains the area of greatest emigration from Algeria, and problems of employment, housing, and the life of the population remain acute.

Other factors are at play, including international market conditions and the results of Algerian foreign policy. The contradictions at work in the process of industrialization in Algeria are far from having produced all their consequences.

– Translated by Peter Korotaev

This text first appeared in Revue française d’administration publique 4 (1977): 123-34. Linhart wrote the piece while working as a consultant for the National Institute of Statistics and Economic Studies in France.

This article is part of a dossier entitled “Robert Linhart and the Circuitous Paths of Inquiry.”

References

| ↑1 | Translator’s Note: “Produced in hand” contracts refers to a new experimental legal concept created the Algerian government. See Abdelouahab Bemmoussa’s thesis on the subject: “The produced in hand contract is a juridical technique tested by Algeria to realize its industrialization. It permits a client of the underdeveloped country to simultaneously acquire working industrial equipment and the necessary skills to use it profitably.” Abdelouahab Bemmoussa, “Le contrat ‘produit en main’ – contribution a l’etude d’une technique juridique pour l’industrialisation de l’algerie,” Thèse de doctorat en Droit privé, University of Rennes, 1988. |

|---|---|

| ↑2 | TN: Demurrage is a charge payable to the owner of a chartered ship on failure to load or discharge the ship within the time agreed. |

| ↑3 | TN: Algerian provinces. |

Viewpoint Magazine

Viewpoint Magazine